excise tax nc real estate

Excise Tax Technical Bulletins. Perquimans County is one of only seven counties in North Carolina that levies a local excise tax on the transfer of real estate.

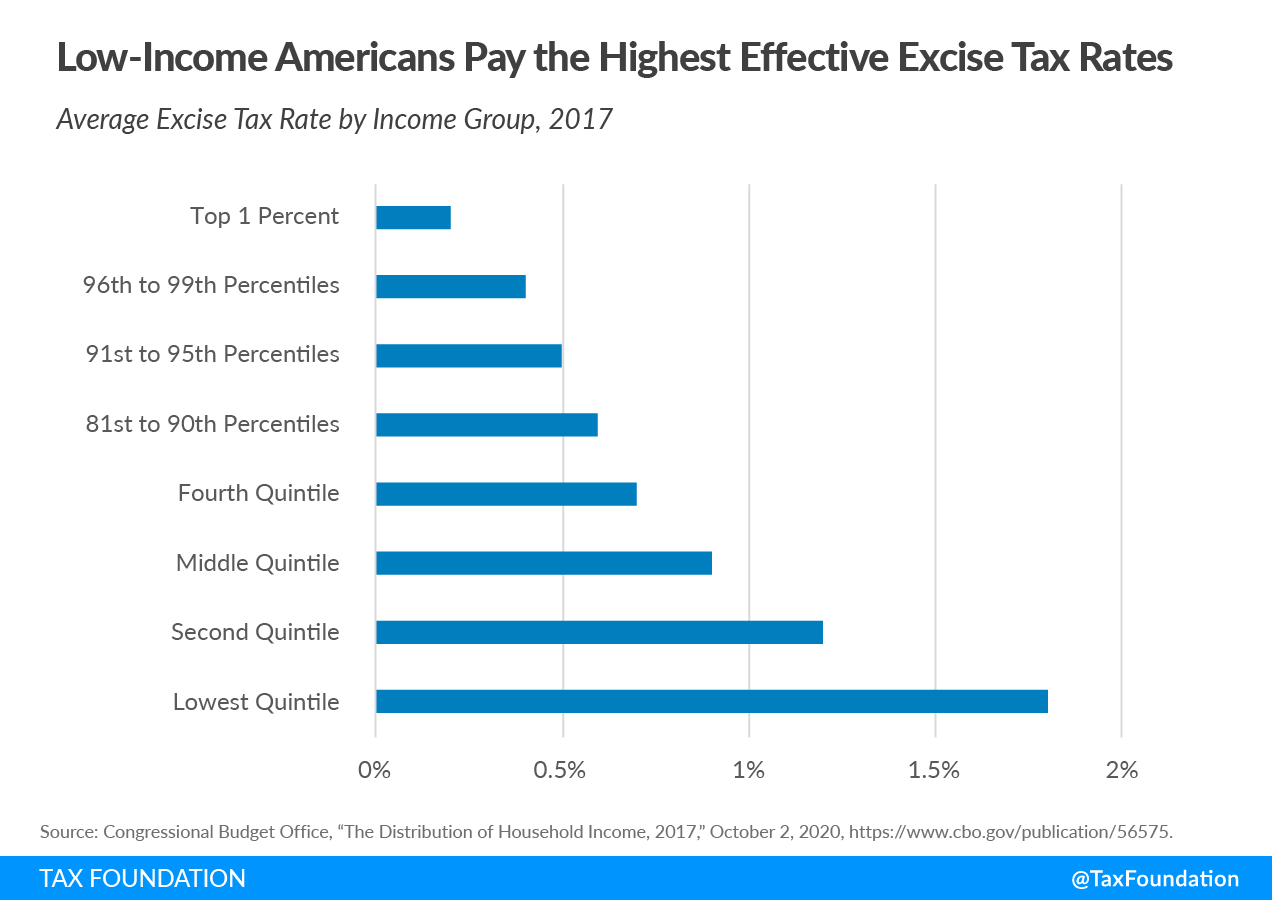

Excise Taxes Excise Tax Trends Tax Foundation

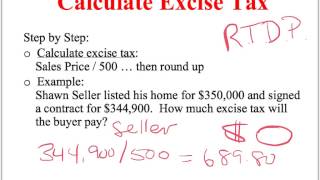

How do I calculate the excise tax on a property.

. Excise Stamp Tax on Conveyances. Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax. For example a 500000 property would have a.

The current North Carolina excise tax stamps are 100 per 50000 or fractional part of the value of the property conveyed. This Article applies to every person conveying an interest in real estate located in North. Its paid by the seller to the escrow agent or the attorney responsible for closing the deal who.

PO Box 25000 Raleigh NC 27640-0640. Sea Coast Real Estate Academys Math Tutorial Series will walk you thr. The North Carolina real estate transfer tax rate is 1 on each 500 of the propertys value.

The REET is calculated as a percentage of the homes selling price subject to the local or state governments real estate excise tax rates state REET rates can range from. How Do You Calculate NCs Excise Tax. The local REET must be calculated and added to the graduated state rate for the total tax due.

Customarily called excise tax or revenue stamps. EXCISE TAX ON CONVEYANCES Article 8E - Title Change. August 22 1977 Subject.

Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina. Conveyance of leasehold improvements owned by lessee. Excise Tax on Conveyances.

This Article applies to every person conveying an interest in real estate located in North Carolina other than a governmental unit or. How can we make this page better for you. Local Real Estate Excise Tax - Rates July 1 2022 and after pdf.

The title of the Article Excise Stamp on Conveyances was changed to replace the word. Are you preparing to take your NC real estate licensing exam but a worried about math. The land transfer tax equals 100 per 10000.

North Carolina Department of Revenue. March 25 1986 Subject. 1 2020 Information Who Must Apply Cig License.

A regular photocopy of a real estate document is 5 per page in-house or 1 by mail. Real Estate Excise Stamp Tax. The tax amount is based on the sale price of the home and varies by state and local government.

2005 North Carolina Code - General Statutes Article 8E - Excise Tax on Conveyances. This title insurance calculator will also. Israel Register of Deeds Transylvania County.

The tax rate is 2 per 1000 of the sales price. The tax is levied on conveyances of. A certified copy of a real estate document is 5 for the first page and 2 each additional page.

Real estate excise tax also known as revenue stamps is imposed by North Carolina law and collected by the Register of Deeds at the time of recording.

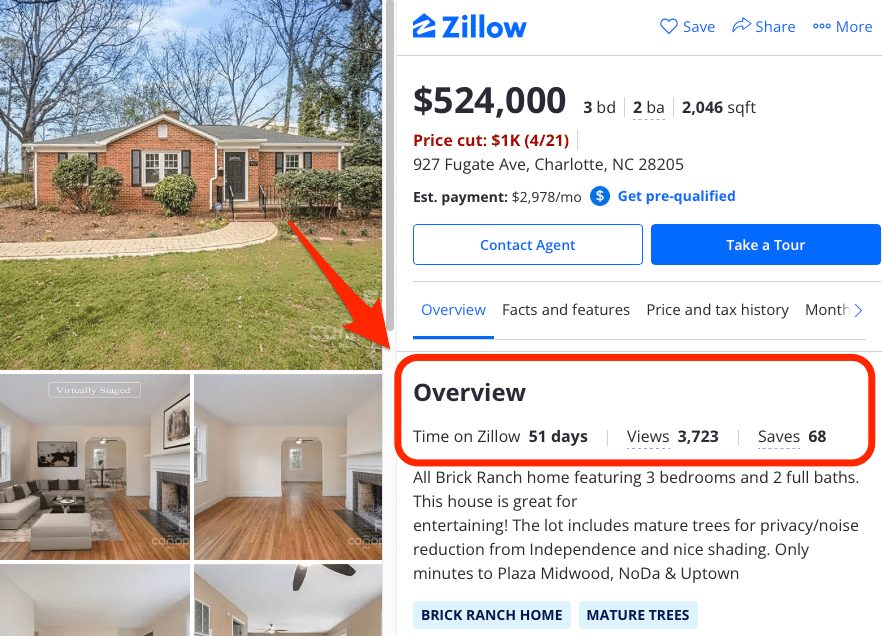

181 Cornel Lane Hampstead Nc 28443 Home For Sale

9 Steps To Selling A House In North Carolina In 2022

Estimated Tax Penalties For Home Resales

Assessor Town Of Yarmouth Ma Official Website

Free North Carolina Special Warranty Deed Form Pdf Eforms

Calculating Excise Tax Help With Closing Statments Youtube

Wake County Real Estate Prices Up In May Even As Lending Activity Competition Decrease Wral Techwire

Lincoln County Slow To Respond To Extremely High Levels Of Cancer Causing Arsenic In Residents Drinking Water Nc Policy Watch

Excise Taxes Excise Tax Trends Tax Foundation

Excise Taxes Excise Tax Trends Tax Foundation

Real And Personal Property Auctions Orange County Nc

Calculating Excise Tax Help With Closing Statments Youtube

Kentucky Has The Highest Wine Taxes In The Country

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center